Great Wealth Transfer: What Boomer Women Say They Would Do With a Financial Windfall

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

While the impending “Great Wealth Transfer” refers to the passing of wealth from boomers to younger generations, there is one step in between. Because women tend to outlive men, wealth will first be transferred to boomer wives in heterosexual marriages — and these transfers of wealth can be very significant, or even life-changing. According to a recent Ellevest survey of more than 2,000 affluent people across the U.S., 45% of women either had received or expected to receive a financial windfall, with the typical amount being around $300,000. As for what these women have done or plan to do with this money, there are some generational differences.

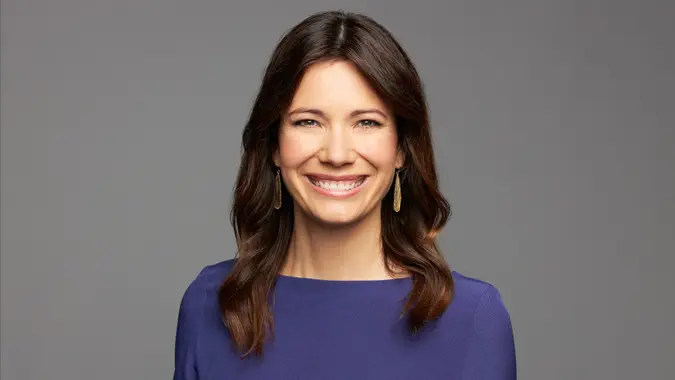

In this “Financially Savvy Female” column, we’re chatting with Emily Green, director of private wealth management at Ellevest, about what boomer women plan to do with a financial windfall — and what they should be doing.

The largest proportion of boomer women (40%) said they would invest a windfall. Is this a good use of money for this age group?

While it always depends on each individual’s specific situation, in general, yes. Most boomer women who are receiving a financial windfall have likely already made big purchases — like a home — and may be at the point in life where they’re looking to downsize. Investing is a way to continue to grow their assets, earn income from the assets and make that money work toward their financial goals.

What are some of the best ways for boomer women to invest a windfall if they go this route?

Again, it depends. That’s why I highly recommend finding a financial advisor who can build a portfolio based on your personal goals and situation.

Are you already retired? If so, you may want a portfolio that balances growth with income. Focusing only on income may seem like the right answer. But depending on someone’s asset size, growth through equities is likely key to continuing to beat inflation and make sure their money lasts their lifetime.

If you’re not already retired, is that your top priority? I have clients in this situation who tell me that spending a certain amount per month and making sure they can comfortably retire is what’s most important to them. I also have a client whose father passed away last month and asked, “Can I retire tomorrow?” No matter if we’re the same age and have the same amount of money, we all have unique personal goals. And it’s important your money is working toward those goals.

The No. 2 answer was putting the money in the bank (32%). Is this a good use of money for this age group?

If they don’t already have savings set aside, it’s important to build an emergency fund by setting aside three to six months of expenses if still working, and six to 12 months of expenses if retired. Once you have that, keeping money in a bank account is likely not a good use of money. While interest rates are high today, it’s widely believed that they’ll come back down — not tomorrow, but it’s good to assume that cash is likely not your best investment over time.

Over time, inflation has eaten into the purchasing power of cash, so $100 you have today doesn’t buy you the same thing in 10 years. I was recently celebrating my dad’s 70th birthday and my mom had a sign of how much the average cost of things were in 1954. The average home cost $10,000 and change. Can you imagine buying a home for $10,000 today? Can you imagine if you kept your money in cash for all those years and earned very little interest?

If they do put money in a bank, are there certain accounts that would be most beneficial?

I’d look for high-yield savings accounts.

The No. 3 answer was using the money to pay off debt, excluding student loans (29%). What are the pros and cons of using the money to pay off debt?

If you have high-interest debt, it’s important to pay that off. If you’re looking at a low-rate mortgage, it typically makes sense to keep this debt. However, I was recently working with a woman who inherited money and she just hated having a mortgage — even though her rate was sub-3%. Based on the numbers alone, you might assume she should keep the mortgage and put her financial windfall toward other goals, but after I ran an analysis for her, it was clear that she could afford to pay it off without changing her long-term plan. In a case like this, money is a tool that can make you more comfortable by paying off the debt.

Tied for No. 3 was using a financial windfall to travel. What are the pros and cons of this?

If you have the money to achieve your core goals and cover everyday spending, travel is a great way to enjoy your new money. Money gives you the power of choice. I always ask affluent women, “What’s the point if you can’t do what makes you happy?” So if traveling is what makes you happy, and you have a financial plan that shows you can afford it, I say go for it!

The No. 4 response was buying a home (25%). What are the pros and cons of this use of a windfall?

If you worked with a financial advisor or planner to make sure buying a home fits within your long-term financial plan, this can be a great use of funds! If you’re buying a home because you feel real estate is either a “safer investment” or an “easier way to make income” if you plan to rent it out, I’d be very careful. Real estate as an investment is typically a lot more work than one thinks it might be. And values of real estate go up and down just like the market — only, you don’t see its price on a screen every day.

Finally, 19% of boomer women said they wanted to invest their windfall for a positive impact. For those with this goal, what are the best ways to do so?

There are many ways to invest for positive impact. First, are you working with a mission-aligned financial advisor? Many people forget about this part. For example, if you care about supporting women, then what does the management team of the company look like? That goes for both the advisors AND the investment team. These are all great questions to ask. Then, work with your financial advisor to develop a values-aligned portfolio. If a financial advisor tells you that you can’t align your money to your values, run! You can find someone who can help you invest across all asset classes in a way that supports the causes you care about.

More From GOBankingRates

Written by

Written by  Edited by

Edited by